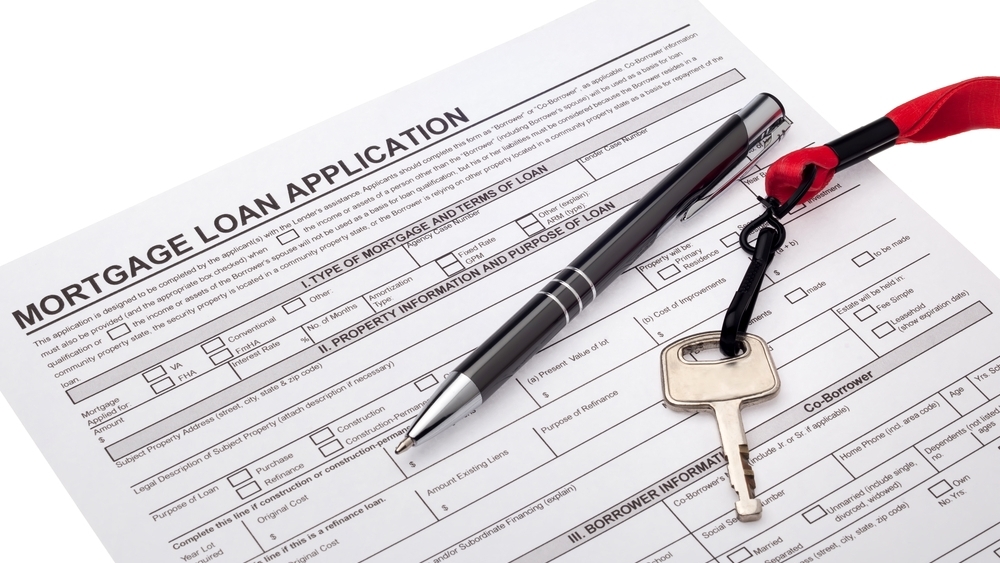

When applying for a mortgage, one of the first decisions a buyer must make is whether to lock in an interest rate on a mortgage. It’s somewhat of a gamble, but can be less stressful by paying attention to financial trends. How the process works. While shopping for homes, it’s also wise to shop for… Read more »