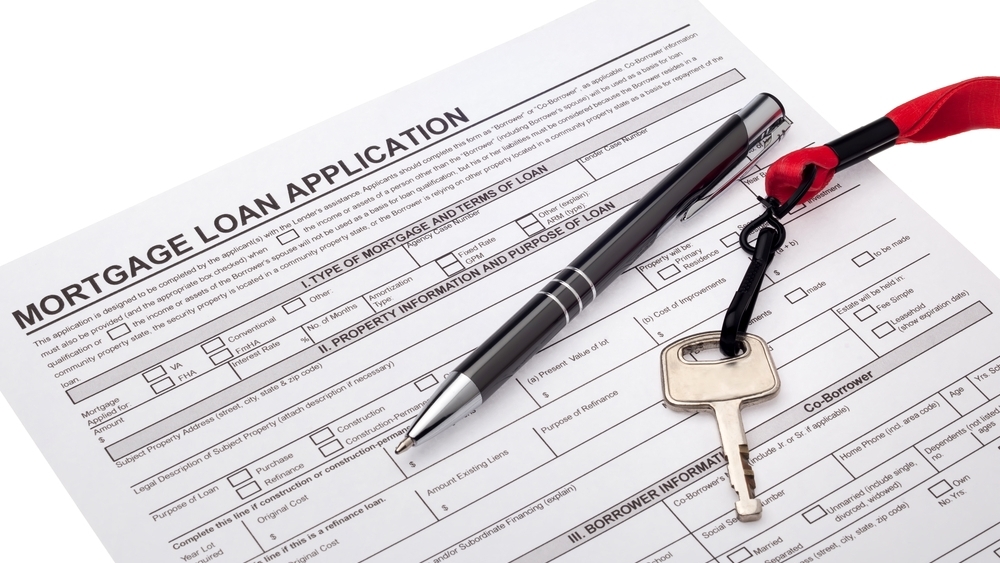

The financial crisis of 2008 started with shoddy mortgage-lending practices. Congress answered this problem with the 2010 Dodd-Frank Act, which was designed, among other things, to tighten mortgage lending standards and disclosures, keeping consumers better informed and curbing predatory lending practices. Here is a quick overview of what the Dodd-Frank Act means to you as… Read more »