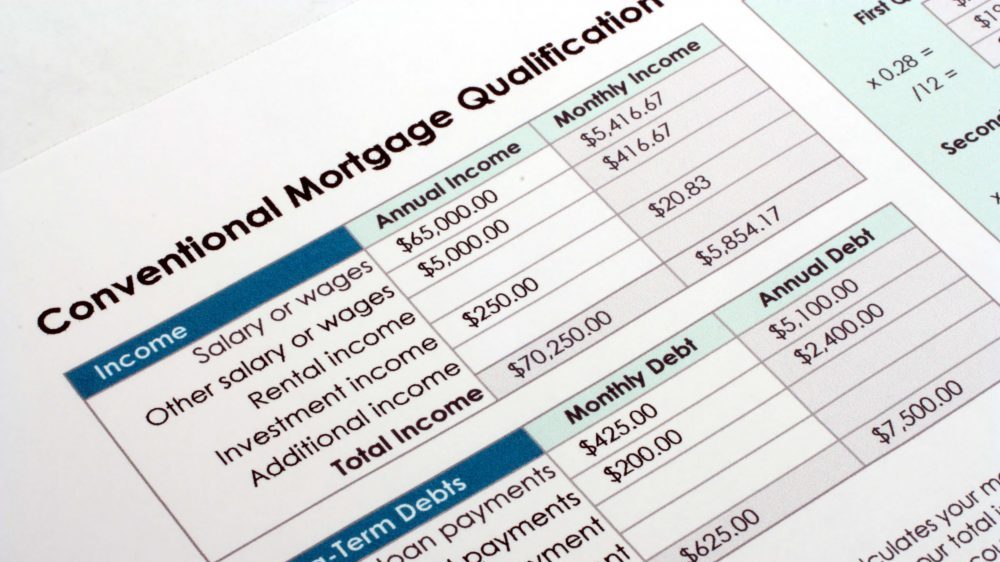

When figuring how much house they can afford, homebuyers with little or no experience may focus solely on the principal and interest portion of their monthly payment. But house payments also include the cost of homeowners insurance. It’s important to research the cost of insuring your home early in the process to avoid unpleasant surprises… Read more »