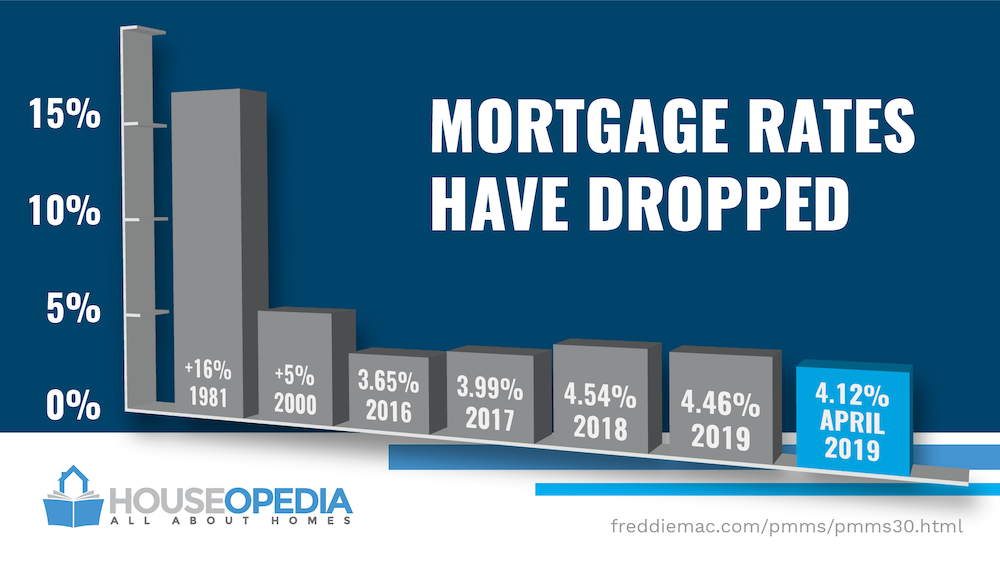

Today’s higher mortgage interest rates have many homeowners hesitant to sell their houses and buy new ones. But the skyrocketing home prices of recent years mean that many of those owners are sitting on substantial home equity. Here’s how that equity can soften the blow of higher interest rates. Two factors increasing home equity Your… Read more »